About us

Overview

i(x) Net Zero (“IXNZ”) is a targeted capital platform founded in 2015 to accelerate the transition to a sustainable, high-performance energy ecosystem. With a disciplined focus on growth equity and real assets in energy innovation, infrastructure, and storage, IXNZ provides shareholders with the opportunity to achieve long-term capital growth and measurable impact.

Our strategy is designed to capture the generational opportunity created by rising global energy demand, electrification, and industrial decarbonization. By backing scalable companies and infrastructure platforms that integrate into the existing energy economy, IXNZ delivers top-tier institutional returns while advancing solutions critical to the energy evolution.

IXNZ aligns shareholder capital with a growing network of strategic partners, family offices, and institutional investors. Through structured investments, active management, and proprietary deal sourcing, we are building a portfolio and pipeline positioned to thrive at the intersection of market demand, energy security, and sustainability.

The Energy Evolution

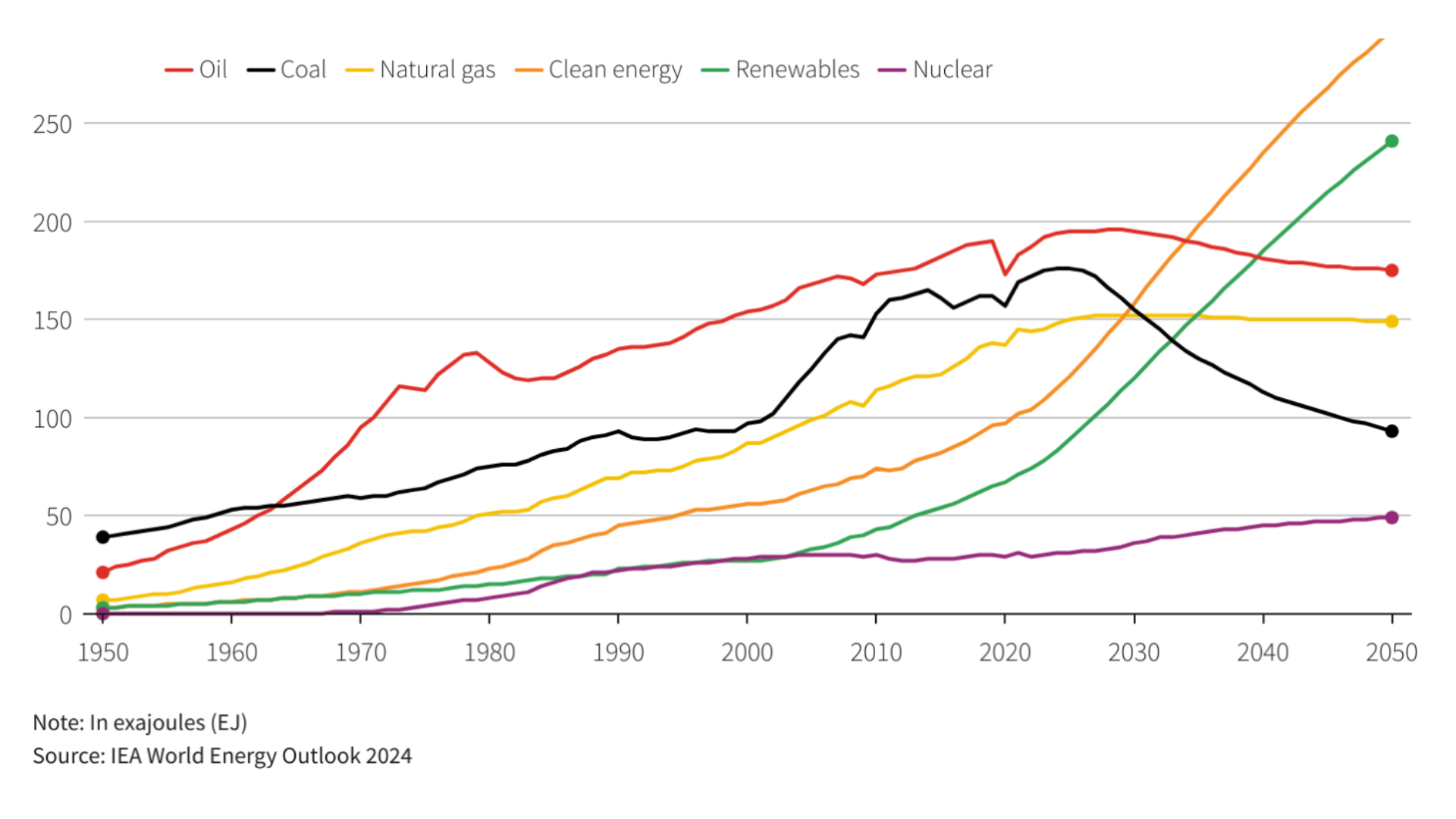

The global energy economy is not simply transitioning, it is evolving. Electrification, AI-driven data centers, and industrial decarbonization are driving record energy demand, requiring solutions that scale rapidly while integrating with existing infrastructure. Meeting this demand means modernizing the grid, deploying large-scale storage, and investing in technologies that deliver reliable, low-carbon power at scale.

The energy evolution spans every sector of the economy. Aviation and maritime shipping must adopt sustainable fuels. Buildings must be constructed and operated with new green technologies. Waste must be transformed into renewable fuels. And carbon capture must move from concept to commercial scale—turning emissions into valuable resources and fueling a carbon-to-value economy.

At IXNZ, we see this evolution as the defining investment opportunity of our time: where innovation and infrastructure converge to create lasting financial returns and measurable climate impact.

In the US alone, $1.4T+ of energy infrastructure investment will be required by 2030 .

![]()

Investment Thesis

The current energy market is defined by a mismatch between surging demand and outdated infrastructure. AI data centers, industrial decarbonization, and electrification are straining grids worldwide, while trillions in capital are required to modernize energy systems. At the same time, generalist capital is retreating from climate funds, leaving many promising assets underfunded or stranded.

IXNZ provides the solution by focusing on the sweet spot between high-growth companies and real energy assets. Our disciplined approach targets cash-flowing or near-commercial businesses with proven demand, proprietary technology, and scalable infrastructure. We structure investments through direct stakes and SPVs, pairing shareholder capital with strategic partners to accelerate growth, secure offtake agreements, and position assets for exit.

This creates a unique opportunity: IXNZ sits at the intersection of innovation and infrastructure, capturing upside from early-stage growth while delivering institutional-grade stability through real assets. It is this balance—growth equity with downside protection—that defines IXNZ’s business model and drives superior returns in the energy evolution.

Our Business Model

IXNZ’s business model is built around a disciplined, three-step investment process designed to maximize returns while de-risking execution. First, we identify and invest in high-growth assets with proven demand, proprietary technologies, and strong market positioning—often at favorable entry valuations. Second, we work closely with management teams and partners to optimize and scale operations, accelerating commercial adoption, securing feedstock and offtake agreements, and enhancing margins. Finally, we execute structured exits through IPOs, acquisitions, or secondary sales, aligning investments with clear liquidity events and value inflection points.

This process allows IXNZ to consistently generate top-tier returns while advancing real-world energy solutions. Our investment focus lies in scalable, cash-flowing or near-cash-flowing businesses where innovation meets infrastructure—opportunities large enough to absorb meaningful capital, yet underserved by generalist funds. By combining growth equity with structured capital and real assets, IXNZ captures both high-growth upside and the stability of inflation-resilient cash flows.

Management Team

Pär Lindström – Founding Partner & CEO, Board Member

Pär co-founded i(x) Net Zero and has grown the firm’s NAV to over $150 million with a portfolio MOIC of 13.7x and IRR of 104%. He has invested more than $3.5 billion globally across energy, renewables, industrials, technology, and infrastructure. Previously, Pär was a senior member of the investment teams at Abu Dhabi Investment Council (ADIC) and Partners Capital, and held roles at Bain & Company’s Private Equity Group and Investor AB. He has advised institutions including Carlyle, TPG, and the Milken Institute. Pär holds a B.S. from UC Berkeley’s Haas School of Business, an MBA from Harvard Business School, and is a two-time Olympian in swimming.

Previously, Mr. Lindström spent over five years as Principal in the Global Special Situations and Private Equity groups at the Abu Dhabi Investment Council ("ADIC"), where he was part of the team that built the newly established sovereign wealth fund by driving direct investments and backing various investment teams across multiple asset classes. Prior to ADIC, he was a Principal at Partners Capital Investment Group, a firm backed by Lord Jacob Rothschild and Sir Ronald Cohen, where he headed up the Private Equity, Growth Capital and Venture Capital investments.

Earlier in his career, Mr. Lindström was co-head of Applied Value's New York office, a global turnaround advisory firm with a growth equity investment arm and a senior investment professional at Investor Growth Capital, part of the Wallenberg family's investment company Investor AB, and Affärsstrategerna VC. Mr. Lindström has also held positions with Bain & Company's Private Equity Groups in Europe and the U.S. and with KPMG Banking & Finance.

He is a former Advisory Board member of Carlyle Partners V and TPG Partners VI as well as a member of Milken Institute Global Capital Markets Advisory Council from 2009 to 2013.

Mr. Lindström holds a Bachelor of Science from University of California at Berkeley, an MBA from Harvard Business School and is a two-time Olympian in swimming.

Jonathan Stearns – Partner & SVP, Investments, Board Member

Jonathan has over 30 years of private capital experience, having managed more than $1 billion in direct and co-investments across growth equity, structured credit, and secondaries. He has held senior roles at AIG, PineBridge, Abbott Capital, and Brevet Capital, and founded Stearns Associated Partners. He currently serves as Executive Chairman of Citron Energy and has held leadership and board positions across clean fuels, ESG, and conservation initiatives. Jonathan earned his BA from The University of the South and studied economics and politics at Cornell University’s graduate school.

Building on his experience in leading the impact investment area at AIG and starting an ESG assessment and valuation company, Mr. Stearns is focusing on working with and investing in companies with superior financial and social return opportunities, including affordable housing and renewable energy.

Mr. Stearns received his BA in History and Political Science from The University of the South and studied economics and politics at the graduate school of Cornell University.

Mr. Stearns has lived in New York City for the last 25 plus years and has two daughters.

Robert McLearon – Interim Chief Financial Officer

Robert is a qualified Chartered Management Accountant with over 25 years accounting, tax, strategic finance and fundraising experience. He has worked for many years in senior finance/consultancy positions for dynamic entrepreneurial companies in the energy, power and natural resources sectors. His experience ranges from M&A/transactions, having worked on fundraisings, restructuring and divestments, to corporate governance expertise gained in AIM listed companies. Robert studied at the University of Warwick where he earned his law degree.

Mark Dennes – Managing Director, Investments

Mark brings more than 25 years of experience in private equity, corporate finance, and project finance, with a proven track record investing over $30 billion in debt, $1 billion in equity, and $100 million in tax equity. He has held senior roles at DNB, BNP Paribas, and MUFG, and served as Managing Director at Cate Street Capital and Time Equities, where he focused on renewable energy, sustainability, and real estate investments. Mark holds a BEc from Macquarie University, an MBA from the University of Rochester, and executive education credentials from the University of Pennsylvania.

Patrick Mitchell – Managing Director, Business Development

Patrick brings more than 20 years of experience as an investor, operator, and advisor across energy, infrastructure, and alternative assets. He is the founder of Bula Capital, advising alternative asset managers, family offices and early-stage ventures on fundraising and investment strategy. His prior roles include Principal at Northern Gulf Partners, Investment Banking Associate at Lehman Brothers/Barclays Capital, and Analyst at Loita Capital Partners. Robert earned his MBA from the University of Virginia (Darden) and a BA from UNC Chapel Hill, where he was an All-American Rugby player.

Remy Bacquiche – Managing Director, Capital Markets

Remy has over 15 years of capital markets experience in London, advising family offices, UHNWIs, and institutional clients across energy, technology, and financial services. He is an FCA-regulated stockbroker with a background in merchant banking, turnaround and restructuring, and FX trading. Remy holds a bachelor’s degree in International Business from the University of Grenoble.

Karina Edwards – Director of Operations

Karina leads operations, finance, and ESG initiatives at i(x) Net Zero, including GHG reporting, board communications, and financial system integration. She previously served as General Manager of Astra-Inks Russia (Meteors Chemicals), where she scaled the business to $1.4M+ in revenue, built and managed a 12-person team, and developed real-time operational and financial reporting tools. Karina holds an M.Eng. in Organic Chemistry from Mendeleyev University and is fluent in English and Russian.

Board & Senior Advisors

Nick R. Hurd, Non-Executive Chairman

Nick served as a Member of Parliament in the UK for 14 years, including as Minister for Climate Change and Industry. He has deep experience in public policy, governance, and sustainability, having played a key role in shaping UK climate legislation and international development initiatives. Prior to politics, Nick spent 18 years in investment banking and fund management.

Carlos N. Guimarães – Senior Advisor

Carlos is Chairman & Partner at LAIG Investments and serves as Chairman of Enphys. He was previously Head of Latin America Investment Banking at Citigroup and Lehman Brothers, leading landmark M&A and capital markets transactions. He is active in multiple regional organizations, including the Americas Society and Brazilian-American Chamber of Commerce.

Jared Carney – Senior Advisor

Jared is the founder of Lightdale LLC, a global holding and advisory firm, and serves as a Senior Advisor to Apollo. Previously, he was Chief Strategy & Marketing Officer at the Milken Institute, where he co-led major global initiatives and partnerships. He has also been a leader in early-stage technology ventures, including Sun’s Java launch, Intranets.com, and Captura. Jared sits on multiple corporate and non-profit boards worldwide.