About us

Overview

i(x) Net Zero PLC, the investing company which focusses on Energy Transition and Sustainability in the Built Environment, was founded in 2015 by Trevor Neilson, Pär Lindström and Howard W. Buffett. It provides its shareholders the opportunity to create long-term capital growth with positive, scalable, measurable and sustainable impact on the environment and on the communities it serves. We accomplish this by investing in sectors that are critical to solving humanity’s most pressing issues, which i(x) Net Zero believes are also the biggest investment opportunities.

As an investing company, i(x) Net Zero is intentionally designed to align the interests of its shareholders alongside investors who can deploy capital into our holdings directly. We share the common goal to produce top-tier, institutional quality returns and achieve measurable, scalable impact.

The Company uses a multi-strategy investment approach, generally providing the companies in which it invests expertise and catalytic capital to help them grow.

Energy transition

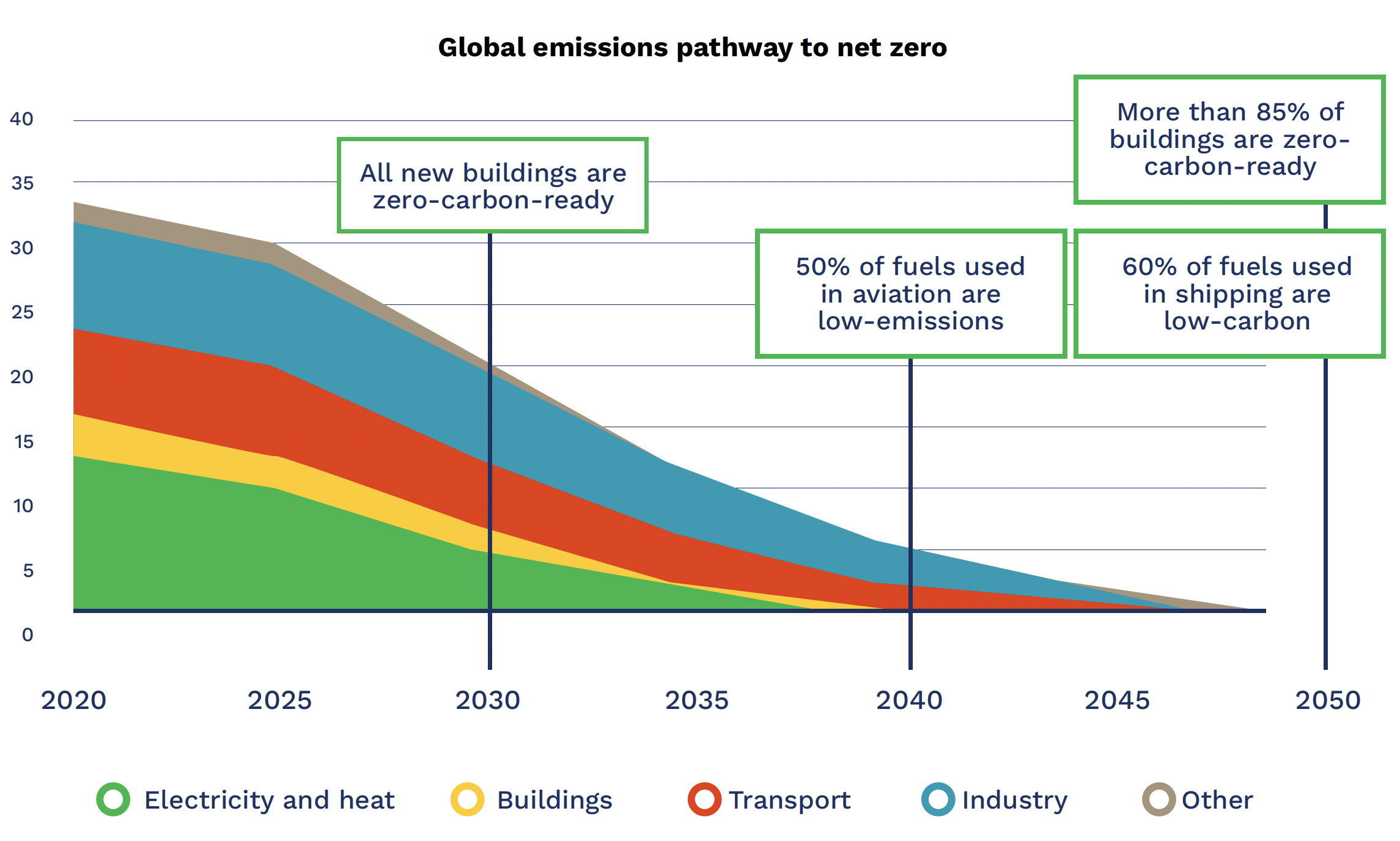

The global economy is at an inflection point within energy transition, transitioning from fossil fuels to renewables and alternative sources of energy. The capital needed to accomplish this will be enormous. All forms of energy being used need to be decarbonised. Buildings need to be constructed and operated with new green technology. Renewable transportation fuels need to be sourced at scale and utilised to fuel a sustainable supply chain. The aviation industry will need to revolutionise its fuel sources. We must move to a carbon to value economy where mitigating our carbon footprint in the atmosphere through new carbon capture technologies creates economic opportunity at industrial scale.

Source: IEA Net Zero by 2050 report

https://www.iea.org/reports/net-zero-by-2050

![]()

Sustainability in the built environment

Sustainability in the built environment refers to the ability to construct, retrofit and operate every form of residential, commercial and industrial building with a reduced carbon footprint and ultimately net zero carbon emissions. This will take the implementation of technology, environmentally friendly building materials and new disruptive construction systems that make possible reduced greenhouse gases and lower operational costs across every sector of real estate. Our current focus in residential housing is to leverage the technology that enables net zero for healthy, affordable living.

Our purpose & values

We believe in profit with purpose.

The Company’s aim is to generate long-term capital growth for its shareholders, principally by creating, funding, partnering with or developing companies that are committed to the areas of energy transition and sustainability in the built environment.

![]()

Business model

i(x) Net Zero’s business model is to accelerate the growth of partner companies through the investment of catalytic capital and proactive engagement. This includes leveraging the team’s long and broad experience in the financial markets to help access international capital to maximise impact through scale.

We evaluate potential investments for their ability to implement sustainable business strategies. In addition to evaluating the financial merits of each investment, we determine from the outset appropriate impact measurement standards and our ability to transparently provide verifiable impact results to our investors.

Our approach is squarely aligned with the long-term secular trend and industrial-scale march towards global decarbonisation—one of the greatest needs for capital and investment opportunities.

The acceleration away from fossil fuels means that buildings will be constructed and operated differently. Ships, planes and every form of transportation will be powered by new fuels and new technology. Our investee companies represent opportunities in some of the fastest growing sectors of this massive transition.

i(x) Net Zero is not a passive investor. We generally provide catalytic capital and hands-on strategic management, resources and infrastructure to help our investee companies grow their businesses. The extensive sphere of influence of our global family office shareholders, aligned industry experts and seasoned executive team allows i(x) Net Zero to guide its companies with world-class expertise and sources of capital that enables them to scale. We remain actively involved in each of our companies in which we invest and seek to support them through consistent interaction with management, business development, active board participation and all phases of capital development.

At the outset of every investment, i(x) Net Zero is consistently intentional with its capital, utilising an investment approach that identifies opportunities that are embedded in the primary sectors of global decarbonisation. Through this singular approach, we synchronise the dual goals of our business purpose: to achieve top-tier returns and measurable, scalable impact. This framework enables us to make investment decisions that recognise the intrinsic ESG standards within each company that align with our and our shareholders’ values.

Board & management

Nick R. Hurd, Non-Executive Chairman of the Board

The Right Honourable Nick Hurd served as a Member of Parliament in the UK for fourteen years before stepping down in December 2019.

Before politics, Mr. Hurd spent 18 years in business, including almost nine years in investment banking and fund management. He was a buy-side analyst and then institutional pension fund manager at Morgan Grenfell Asset Management. At Flemings Investment Bank, he was Managing Director of the full service Brazilian subsidiary which he set up; after negotiating a joint venture to scale the business in Brazil, he served on the new board and focused on investment banking advisory.

Mr. Hurd has a long involvement in climate change policy. He served in Parliament on the UK Environment Audit Committee, the Climate Change Bill scrutiny committee and as chair of the All Party Environment Group. In addition, he served as the UK International Development Minister, which included responsibility for climate change and climate finance. He also served as UK Minister for Climate Change and Industry, where he provided oversight of carbon budgets, clean growth strategy, ratification of the Paris Agreement and international climate finance.

As one of the longest serving Ministers for Civil Society, Mr. Hurd led the Government work that helped establish the UK as a world leader in developing the impact investment market. He is Chair of the Access Social Investment Foundation, a Global Ambassador for the Global Steering Group for Impact Investment (GSG) and serves on the Advisory Council for the UK Institute for Impact Investment. Mr. Hurd is on the board of the National Citizen Service Trust, a not-for-profit set up by Royal Charter. In July 2021 he was asked to chair an industry-led Impact Investment Taskforce set up with the support of the G7 Presidency.

Pär A. Lindström, Chief Executive Officer and Chief Investment Officer

Pär Lindström is Co-Founder, Chief Executive Officer & Chief Investment Officer

Previously, Mr. Lindström spent over five years as Principal in the Global Special Situations and Private Equity groups at the Abu Dhabi Investment Council ("ADIC"), where he was part of the team that built the newly established sovereign wealth fund by driving direct investments and backing various investment teams across multiple asset classes. Prior to ADIC, he was a Principal at Partners Capital Investment Group, a firm backed by Lord Jacob Rothschild and Sir Ronald Cohen, where he headed up the Private Equity, Growth Capital and Venture Capital investments.

Earlier in his career, Mr. Lindström was co-head of Applied Value's New York office, a global turnaround advisory firm with a growth equity investment arm and a senior investment professional at Investor Growth Capital, part of the Wallenberg family's investment company Investor AB, and Affärsstrategerna VC. Mr. Lindström has also held positions with Bain & Company's Private Equity Groups in Europe and the U.S. and with KPMG Banking & Finance.

He is a former Advisory Board member of Carlyle Partners V and TPG Partners VI as well as a member of Milken Institute Global Capital Markets Advisory Council from 2009 to 2013.

Mr. Lindström holds a Bachelor of Science from University of California at Berkeley, an MBA from Harvard Business School and is a two-time Olympian in swimming.

Jonathan C. Stearns, Chief Financial Officer

Mr. Stearns, CFO, brings over 35 years of experience as a senior executive in private capital investing and management across numerous industries, capital structures and stages of development in companies located in the U.S., South America, Western Europe and Asia.

Building on his experience in leading the impact investment area at AIG and starting an ESG assessment and valuation company, Mr. Stearns is focusing on working with and investing in companies with superior financial and social return opportunities, including affordable housing and renewable energy.

Mr. Stearns received his BA in History and Political Science from The University of the South and studied economics and politics at the graduate school of Cornell University.

Mr. Stearns has lived in New York City for the last 25 plus years and has two daughters.

Alice G. Chapple, Non-Executive Director

Alice Chapple is a U.K. citizen and resident who is an economist and a specialist in impact investment and impact assessment.

Before establishing Impact Value, Ms. Chapple worked as Director of Sustainable Financial Markets at Forum for the Future, where she worked on projects exploring the scope for innovative financial instruments, more effective valuation techniques, better risk assessment and longer-term investment strategies. Prior to that role, she worked for many years at UK development finance institution, CDC Group Plc, as financial analyst, fund manager and social and environmental advisor. In the late 1990s, she established a programme for the evaluation of development impact, and in the 2000s she designed processes for fund managers to assess the ESG aspects of their investments.

Ms. Chapple's current roles include Chair of Investor Watch Group which seeks to align capital markets with a sustainable future through Carbon Tracker and Planet Tracker, two financial think tanks, Independent Director of the Schroders BSC Social Impact Trust PLC, Trustee of the Shell Foundation and member of the Advisory Boards of Frontier Finance Solutions, WHEB Asset Management and Connected Asset Management. She has also developed a sustainable finance course for the University of Cambridge Institute of Sustainability Leadership.

Ms. Chapple has an MA in Economics from Cambridge University and is a chartered accountant.

Patricia J. McCall, Non-Executive Director

Patricia McCall is a U.S. citizen, based in the New York area, with more than 20 years of international experience in philanthropy advising, investment management, economic development, regulatory reform, and education.

She has developed private-public partnerships, led policy institutes and designed investments and initiatives to maximise return and impact. She has worked in the United States, the Middle East, and the United Kingdom. Ms. McCall has a background in philanthropy, impact investing and global development. She worked for the International Finance Corporation (“IFC”) in Cairo, guided philanthropic programming for several family-led foundations in the Middle East, and led the Center for Economic Growth at the INSEAD campus in Abu Dhabi, Europe's leading graduate school of business.

Ms. McCall holds an M.A. in development economics from the Columbia University School of International and Public Affairs and a B.A. in economics from the University of Virginia.